Value creation model

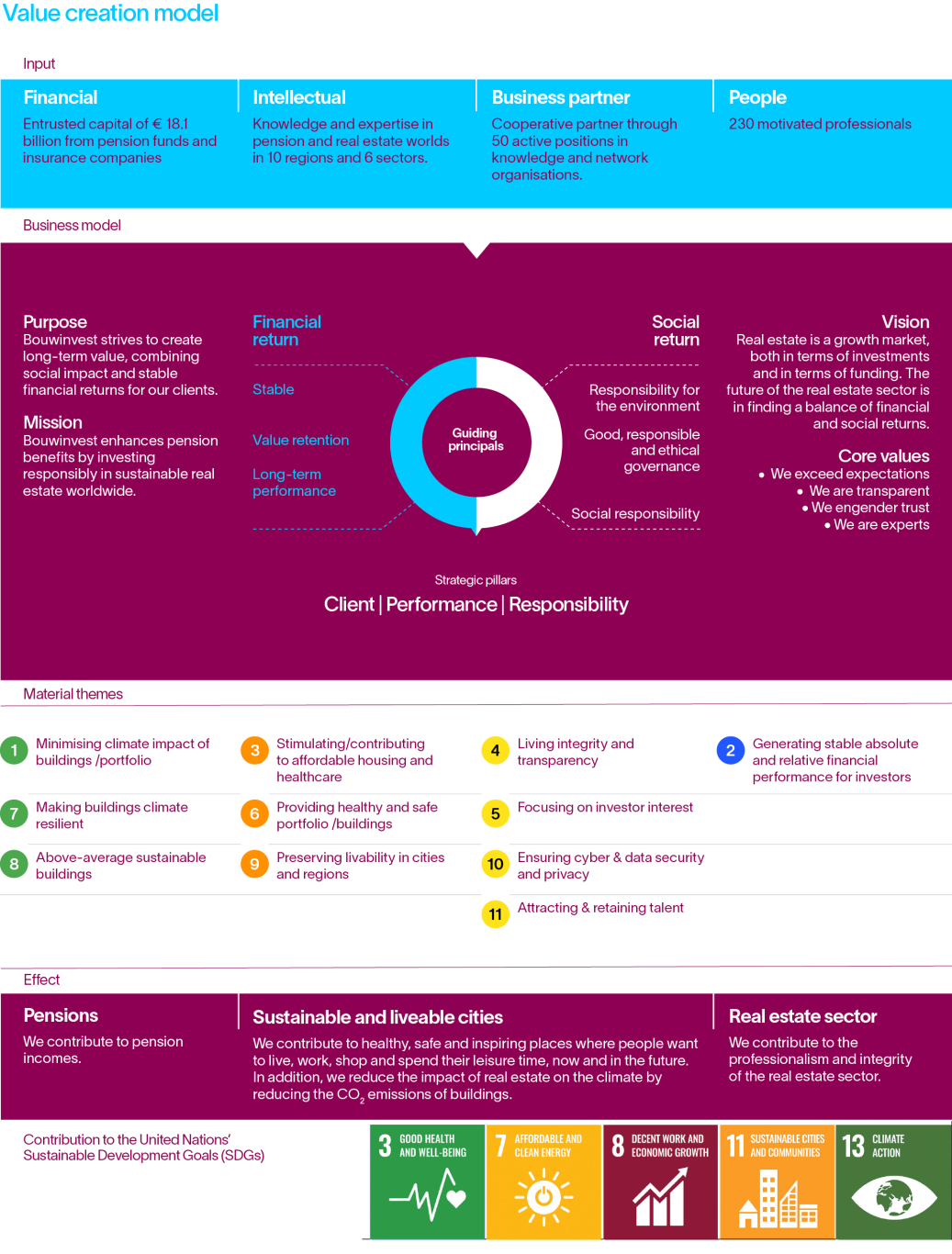

Bouwinvest’s value creation model shows what financial, social and human capital is deployed, how value is added and what value ultimately is created for society. Gaining an understanding of how these various aspects are related helps Bouwinvest to reflect on the impact it has on society and to take appropriate action. The KPIs shown in the connectivity table on page 22 have been defined per material theme, including how to monitor and measure them.

Bouwinvest includes environmental, social and governance (ESG) criteria in all its investment decisions to ensure long-term sustainable returns, in line with the United Nations Principles of Responsible Investment (UN PRI). By endorsing the UN PRI, Bouwinvest recognises the importance of responsible investments and is committed to implementing the principles in its investment process.

Bouwinvest is also committed to achieving the targets laid down in the Paris climate agreement. Its long-term goal is to have a near energy-neutral portfolio - a Paris Proof portfolio - by 2045.

Bouwinvest aims to have above-average sustainability ratings (GRESB 4 or 5 stars) for at least 80% of its invested capital, and to make a positive contribution to the United Nation’s Sustainable Development Goals (UN SDGs). Bouwinvest is explicitly committed to the five Sustainable Development Goals (SDGs) that fall within its sphere of influence:

-

Health and well-being (SDG 3): invest in healthcare real estate, healthy buildings and lifecycle-proof homes.

-

Affordable and clean energy (SDG 7): reduce energy use and invest in renewable energy.

-

Decent work and economic growth (SDG 8): maintain an active dialogue with our partners to ensure good health, safety and working conditions at building sites.

-

Sustainable cities and communities (SDG 11): invest in real estate with an above-average sustainability rating and in affordable homes.

-

Take urgent action to combat climate change and its impacts (SDG 13): invest in sustainable and climate-adaptive real estate, which will result in a near energy-neutral portfolio in 2045.