Performance on sustainability

Highlights performance on sustainability 2023

KPIs | 2023 | 2022 | |

1. Building a future-proof and sustainable portfolio | |||

Above-average sustainable fund | Improvement annual GRESB score | 93 | 92 |

GRESB (5-)star rating | 5 | 5 | |

Above-average sustainable buildings | BREEAM-NL In Use very good or better - Asset score | 96% | 96% |

BREEAM-NL In Use very good or better - Management score | 79% | 70% | |

2. Reducing environmental impact | |||

Combatting climate change: source of energy | Gas-free assets (%m2) | 61% | 63% |

Scope 2 CO2 emissions in kg CO2 m2 (electricity purchased by the Fund) | 0 (All compensated) | 0 (All compensated) | |

Combatting Climate Change: Energy efficiency of buildings | Average energy intensity* | 134 | 137 |

3. Liveable, affordable, attainable and inclusive places where people want to reside | |||

Tenant health and well-being | BREEAM In-Use health assessment score on asset level | As from 2024 | N/A |

BREEAM In-Use health score on management level | As from 2024 | N/A | |

Product accountability | Tenant satisfaction score | 7.3 | 7.3 |

4. Contributing to healthy, safe and responsible operations | |||

Considerate constructors scheme (construction sites) | Construction sites with considerate constructors scheme (%€) | N/A | N/A |

*Concerns BENG2 score (theoretical primary building-related energy consumption) |

Promoted ecological and social characteristics

The Fund promotes ecological and social characteristics and is therefore classified as an Article 8 product according to the SFDR. In 2023, the Fund introduced its ESG Framework, which explicitly defines all ESG-related elements for the Fund. The Fund has defined four ESG objectives, which reflect the environmental and social characteristics that the Fund promotes. The ESG objectives are at the heart of the Funds’ strategy and support four United Nations Sustainable Development Goals (SDGs).

-

Building a future-proof and sustainable portfolio;

-

Reducing environmental impact;

-

Liveable, affordable, attainable & inclusive places where people want to reside – now and in the future;

-

Contributing to healthy, safe and responsible operations.

1. Building a future-proof and sustainable portfolio

Above-average sustainable fund

In 2023, the Fund retained its GRESB 5-star rating and saw an increase in its overall score of one point to 93 points (from 92 in 2022). The higher score was mainly due to an increase in scores on GHG, water and waste due to a better performance on those indicators. Also, the Fund scored higher on like-for-like reductions in energy consumption. The Fund will continue to focus on both coverage of data and on reductions to improve its score this year. Other opportunities for future improvements are related to the reuse of water.

GRESB scores 2023

Above-average sustainable buildings

The target for 2023 was to achieve a minimum of a BREEAM-NL Very Good rating for every asset in the portfolio. The Fund almost met its target last year, as 96% of the portfolio assets now have at least a BREEAM-NL Very Good rating at asset level and 79% for management. No less than 66% have a BREEAM-NL Excellent rating. The Fund has retained its target for 2024 based on its ESG Framework. The asset The Bell (Amsterdam), delivered in November, did not yet have a BREEAM-NL label on 31 December. The Bell will be certified using de V6 version of BREEAM in 2024.

The figure below shows all the certificates obtained per asset.

BREEAM scores (% of lettable floor space)

2. Reducing environmental impact

Bouwinvest committed itself to the Paris Proof commitment of the Dutch Green Building Council (DGBC). The Fund has drawn up a roadmap to realise its ambition to be net-zero carbon (Paris Proof) before 2045, In 2023, the Fund incorporated the technologies, measures and costs in the Fund's strategic maintenance plan for the coming years.

Combatting Climate Change: source of energy

The Fund’s long-term goal is to have a portfolio that consists of 100% gas-free assets in 2045. Gas-free offices account for 61% of total assets. Seven assets have a gas connection, in addition to the thermal energy storages systems that are occasionally supplied with gas. Four of these connections are for cooking facilities in restaurants and a decorative fireplace. Two relate to assets that the Fund intends to sell. One asset has gas-fired heating and the Fund is mapping out the possibilities for linking this asset to an existing local thermal energy storage system to make the building gas-free.

The Fund has set a new target for combatting climate change, with a focus on scope 2 emissions. The Fund's target is to have no scope 2 emissions each year. In 2023, the Fund had zero scope 2 emissions.

Combatting Climate Change: energy efficiency of buildings

The Fund reduced the average energy intensity of its portfolio by 2% to 134kWh/m2 in 2023 (137kWh/m2 in 2022). This is in line with the targeted reduction per year. The results shown are based on the information from the energy labels of all the office spaces. In the coming years, the Fund will make a major effort to report on the basis of actual energy consumption. To do this, the Fund needs to increase the data coverage of the energy use of its tenants.

For 2024, the Fund has set yearly reduction targets regarding its efforts to reduce its environmental impact.

3. Liveable, affordable, attainable & inclusive places where people want to reside - now and in the future

Product accountability: tenant satisfaction

The target for the tenant satisfaction score is ≥7.0 and with a score of 7.3 the Fund achieved this target in 2023. Tenant satisfaction is measured annually, by an external agency. In 2023, a total of 116 tenants (59%) completed the survey, which was slightly lower than in 2022 (119, 65%) and also just below the target of 60%. The Fund is planning to take action to improve the survey request, with the aim of achieving a future response rate of more than 60%.

This survey provides the opportunity to gain insight into the satisfaction of tenants with their office building and the services of Bouwinvest and its partners, such as property managers. The average satisfaction score (weighted by number of tenants) for the office buildings was 7.3. The services provided by the property manager scored 6.9. The financial aspect (including service costs) was viewed more negatively last year, due to the exceptionally high rent indexations and increased energy costs. However, our property managers devoted extra attention to communications with tenants, which led to an increase in the appreciation of this element (7.5 versus 7.2 in 2022) and this is expected to increase thanks to the roll-out of the Chainels communication platform across the portfolio in 2024.

4. Contributing to healthy, safe and good working conditions

Considerate constructors scheme (construction sites)

All the construction sites related to assets in the Fund must be registered under the Dutch Considerate Constructors Scheme (Bewuste Bouwers). This ensures that the contractor deals with the concerns of local residents and addresses safety and environmental issues during the construction phase.

The target was to have more than 75% of its construction sites registered under the Considerate Constructors Scheme by the end of 2023. However, at the end of 2023 the Fund has no construction sites.

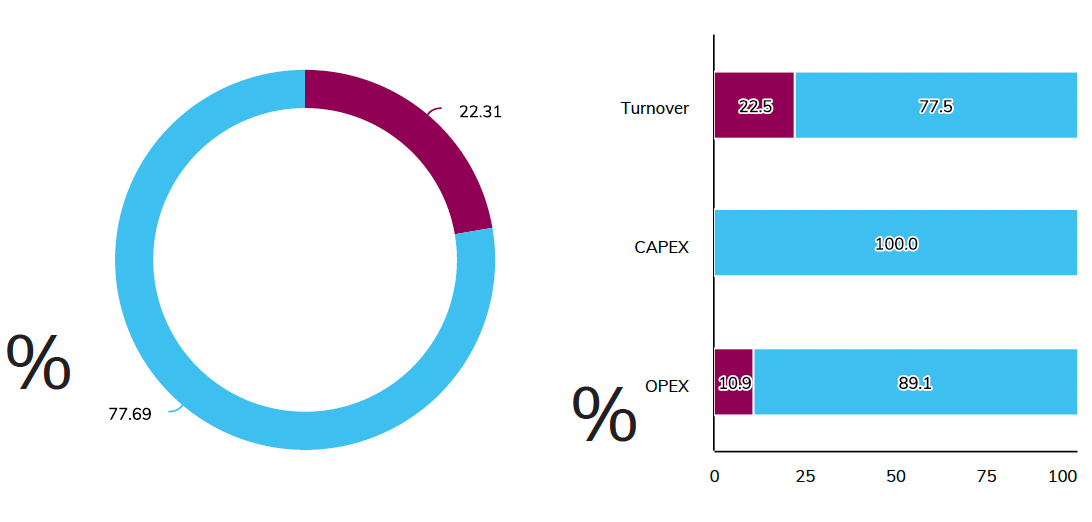

EU Taxonomy

The Fund’s investments are in Taxonomy-eligible economic activity, namely the ‘acquisition and ownership of buildings’. We take into account all standing assets that are the whole year in portfolio. The Fund choose for its activities to substantial contribute to the mitigation of climate change (article 10 of the Taxonomy Regulation). All assets are aligned with the definition of substantial contribution to climate change mitigation. At the same time the activities should not significantly harm other environmental objectives and are carried out in compliance with the minimum safeguards. The adaptation to climate change risk analyse, for the do not significantly harm criteria, is only done for the gross risks. A large part of the portfolio has a high gross risk for adaptation to climate change. The calculation uses asset-level data for the Green Asset Ratio (GAR). The graphs below show the results expressed in GAR, turnover, OPEX and CAPEX which are calculated on the basis of the corresponding (sustainable) assets. This results in only 22% of the assets are in line with the EU taxonomy.

Taxonomy alignment of investments